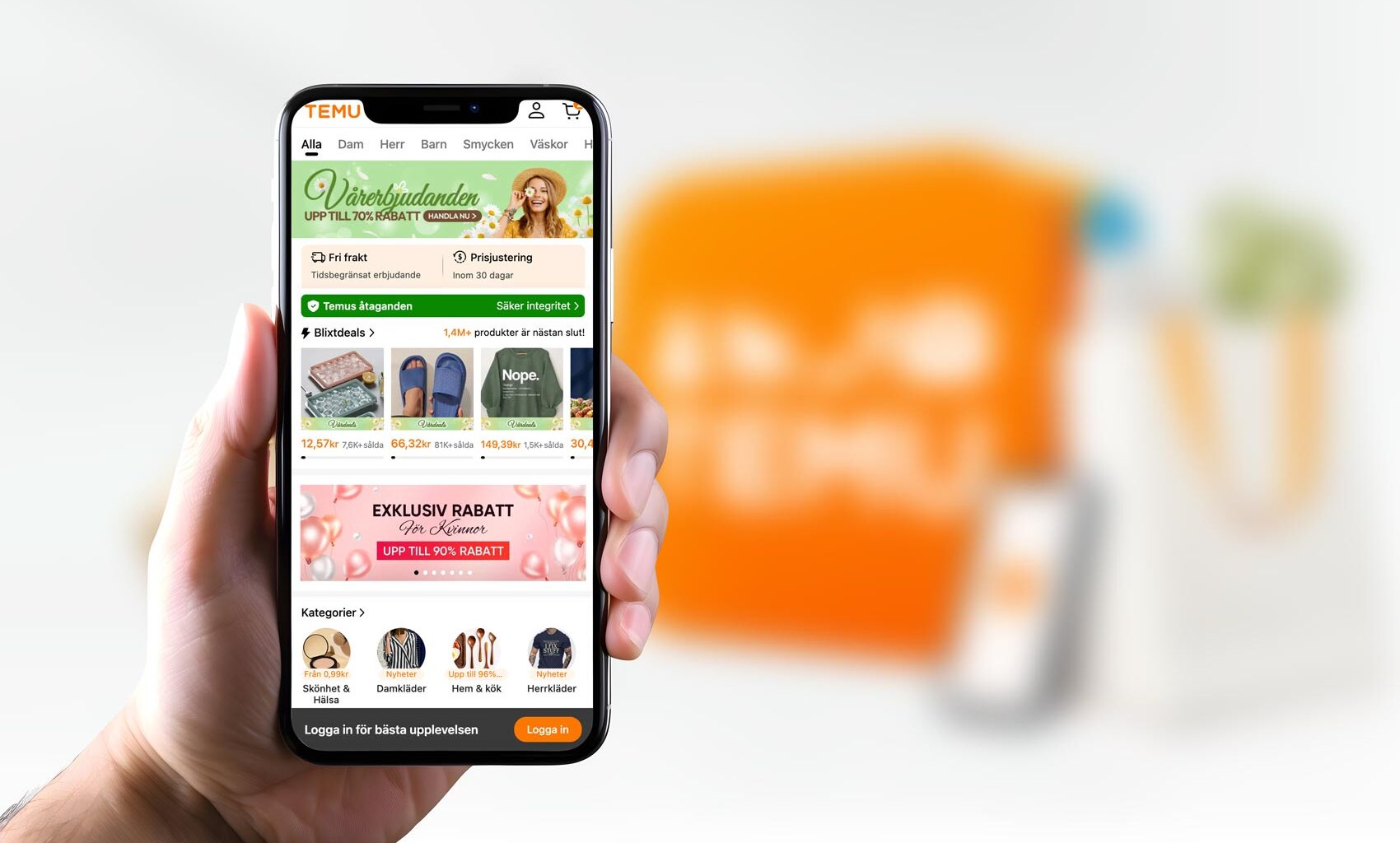

I see this being discussed quite a lot in Facebook groups and at events, the looming shadow that perhaps previously was held by Amazon, is not very much the silhouette of another giant: Temu.

Today, I want to shed some light on this growing concern in Sweden’s e-commerce landscape, particularly among business owners who are grappling with the emergence of this low-price, high-turnover and very aggressive competitor. It’s time to look more into this Chinese e-commerce platform, owned by PDD Holdings, who has been making significant waves in the industry, both in its home country and globally. Let’s start!

In a recent FT News Briefing podcast, the hosts delved into the murky business model of Temu and its parent company, PDD Holdings. I had the opportunity to listen to the podcast, and I’d like to share some key insights and concerns raised by the Financial Times reporters.

Temu, often described as an online flea market, has rapidly expanded its reach, launching its platform in 49 countries. The company is known for offering products at extremely competitive prices, with items shipped directly from Chinese factories to customers worldwide. This approach has contributed to Temu’s substantial growth, leading to a doubling of revenues in the last quarter.

However, what makes Temu and PDD Holdings particularly intriguing is the lack of transparency surrounding their operations. PDD Holdings, the company behind Temu, operates as somewhat of a black box, with limited financial disclosure, undisclosed partners, and a notable absence of information about its warehouses. This opacity is unusual for a publicly-listed company on the American stock market, especially one valued at over $150 billion.

One aspect that has caught the attention of industry observers is the disparity between Temu’s immense size and its relatively small workforce. With approximately 13,000 full-time employees, Temu manages a vast and complex business, raising questions about the efficiency of its operations.

Despite the concerns about transparency, Temu continues to attract significant attention from investors, particularly in the United States. The company’s impressive growth and increasing profits make it an appealing prospect for those seeking the next big investment opportunity.

However, as an investigative reporter at the Financial Times, Dan McCrum, pointed out in the podcast, there are legitimate questions about the sustainability of Temu’s business model. The lack of information about product safety standards and the overall opaqueness of the company raise concerns about the long-term viability of Temu and its parent company.

In conclusion, while Temu’s growth and global expansion are undeniably remarkable, the opacity surrounding its operations and the potential risks associated with such a business model warrant careful consideration. As e-commerce owners in Sweden navigate the challenges posed by Temu, it’s crucial to stay informed about the evolving landscape and make well-informed decisions for the future.